Welcome to the World of Diversification: Why This Guide Matters

Hey there! I’m thrilled you’re diving into this guide. Whether you’re just starting your investment journey or looking to fine-tune your portfolio, understanding diversification is absolutely crucial. I’ve been teaching this stuff for years, and let me tell you, there’s a lot more to it than just simply spreading your money around. So, why does this guide exist? Well, I vividly remember when I first started out, feeling completely overwhelmed by all the jargon and conflicting advice. I wished for a guide that was not only informative but also genuinely engaging and easy to understand. So, here it is – my attempt to cut through the noise and give you something truly valuable.

Why Diversification? It’s More Than Just a Buzzword

So, why all the fuss about diversification? It’s far from just a buzzword thrown around in investment circles. In my experience, it’s arguably one of the smartest, most fundamental strategies to manage risk effectively. Think of it like this: would you rather have all your eggs precariously balanced in one basket, or thoughtfully spread across several? When, inevitably, one basket drops (and trust me, they do!), you still have others intact. That’s the essence of diversification. But here’s the fascinating thing, and what often surprises people—it’s surprisingly tricky to get it just right. For instance, even in a dynamic market environment like 2024, diversified portfolios have consistently shown greater resilience against unexpected shifts compared to highly concentrated ones.

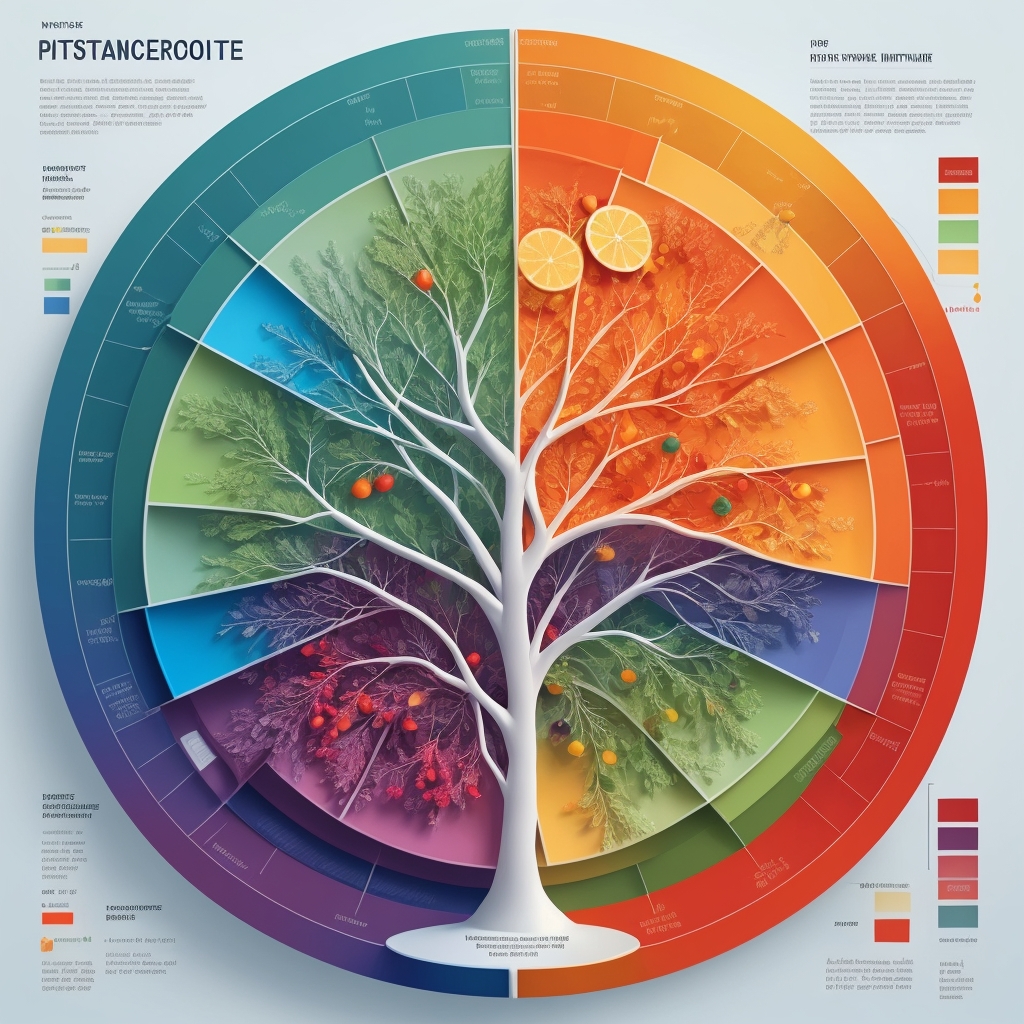

Understanding the Basics: The Different Flavors of Diversification

Let’s start with the foundational elements. Diversification can generally be categorized into a few key types:

- Asset Diversification: This is about strategically spreading investments across different asset classes like stocks, bonds, real estate, and even commodities. I remember when I first truly grasped the power of this. My portfolio had taken a significant hit during a market downturn, but because I had a solid mix of bonds and some alternative assets, the overall impact wasn’t nearly as severe as it could have been. It’s a classic example of how uncorrelated assets can cushion the blow.

- Geographic Diversification: Don’t just stick to your home country’s markets. It’s a common mistake, but the world is a big place with diverse economies. Consider international markets. Different regions have unique growth rates, economic cycles, and, importantly, different risk profiles. A downturn in one part of the world might be offset by growth elsewhere.

- Sector Diversification: Invest across various industries. Technology, healthcare, finance, consumer goods—you name it. Each sector has its own cycles, driven by different factors. Diversifying across sectors can help smooth out the bumps that come with industry-specific challenges, ensuring your portfolio isn’t overly reliant on any single area’s performance.

The Fine Line: When Diversification Becomes Dilution

Now, here’s a question I get a lot, and it’s a really good one: “Can you over-diversify?” The short answer is, unequivocally, yes. While diversification is brilliant for reducing risk, it can also, frustratingly, dilute potential returns if taken to an extreme. The trick, then, is to find that sweet spot—the “efficient frontier” as Modern Portfolio Theory (MPT) calls it, where you’re maximizing returns for a given level of risk.

I once had a client who, with the best intentions, owned nearly 50 different stocks, genuinely believing more was better. But managing that many investments meant he wasn’t really focused on any of them, and his returns were, frankly, mediocre. We meticulously pared it down to a more focused 20-25 holdings, still very diversified across asset classes and geographies, and his risk-adjusted returns noticeably improved. It’s about quality and strategic allocation, not just quantity. In fact, studies suggest that a significant amount of unsystematic risk can be diversified away with as few as 12-20 stocks, though the exact number can vary.

Advanced Insights: Clever Techniques for Smarter Diversification

Alright, let’s dive into some advanced insights that can truly elevate your approach. One clever technique that’s gained traction is risk parity. This involves allocating your portfolio based on the risk contribution of each asset rather than simply its capital allocation. It’s a bit more nuanced than it appears, requiring a deeper understanding of asset correlations, but when done right, it can create a remarkably balanced risk profile across your entire investment universe. It’s a concept rooted in the enduring principles of Modern Portfolio Theory, which remains highly relevant in 2025 for optimizing portfolios.

Also, don’t overlook alternative investments. Things like certain commodities, Real Estate Investment Trusts (REITs), or even private equity (for accredited investors) can add a unique, often lower-correlated, layer of diversification that traditional stocks and bonds might not offer. For instance, real estate, through REITs, can provide both income and potential inflation hedging, acting differently from equity markets.

Common Questions: Tackling the Tricky Bits

Now, onto some common questions that often trip people up. “When should I diversify?” is a big one. In most cases, it’s good to start as soon as you begin investing, making it an integral part of your initial strategy. But here’s the thing though, diversification isn’t a one-time task you check off and forget. Your financial goals, personal risk tolerance, and the broader market conditions are constantly changing, so your portfolio should evolve right along with them. Regular rebalancing is key.

Another crucial question: “How do I know if I’m diversified enough?” A good rule of thumb is to look at your portfolio’s correlation. If your investments tend to move up and down together too much—meaning they’re highly correlated—it might be time to diversify further. The goal is to find assets that don’t perfectly mirror each other’s movements, because that’s where the true power of risk reduction lies. After all, historical data consistently shows that asset allocation, the very essence of diversification, accounts for a significant portion—often cited as 80-90%—of a portfolio’s return variability over time.

My Personal Recommendations: Taking the Next Steps

So, where do you go from here? Start by honestly assessing your current portfolio. Are you too concentrated in one area, perhaps unknowingly? Use the insights from this guide to make thoughtful adjustments. And please, don’t hesitate to seek professional advice if you feel overwhelmed or need a more tailored strategy. Diversification is truly a journey, not a destination, and it’s one I hope you’ll enjoy as much as I do.

Thanks for sticking with me through this guide. Remember, investing is as much about continuous learning and adapting as it is about earning. Happy investing!

Tags: #InvestingBasics #Diversification #PortfolioManagement #RiskManagement #InvestmentStrategy #FinancialPlanning #AssetAllocation #AdvancedInvesting